June 2024

Market Report Yvette Stout June 18, 2024

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

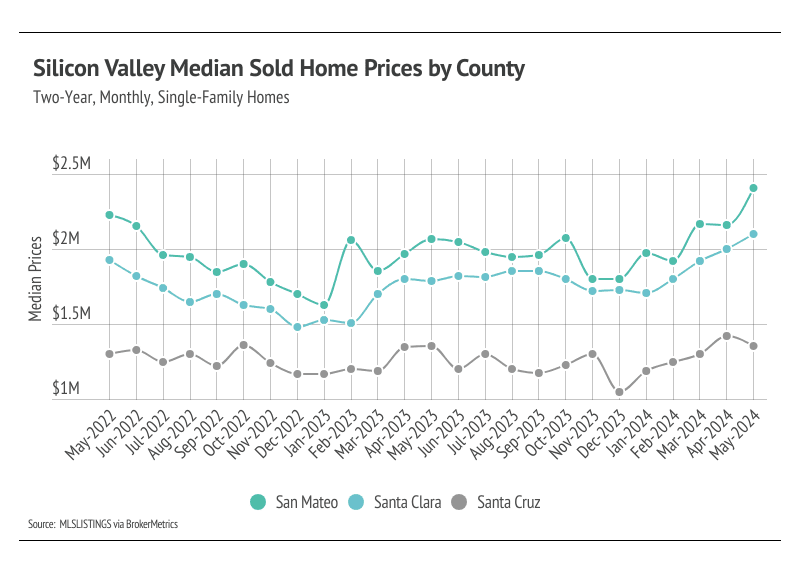

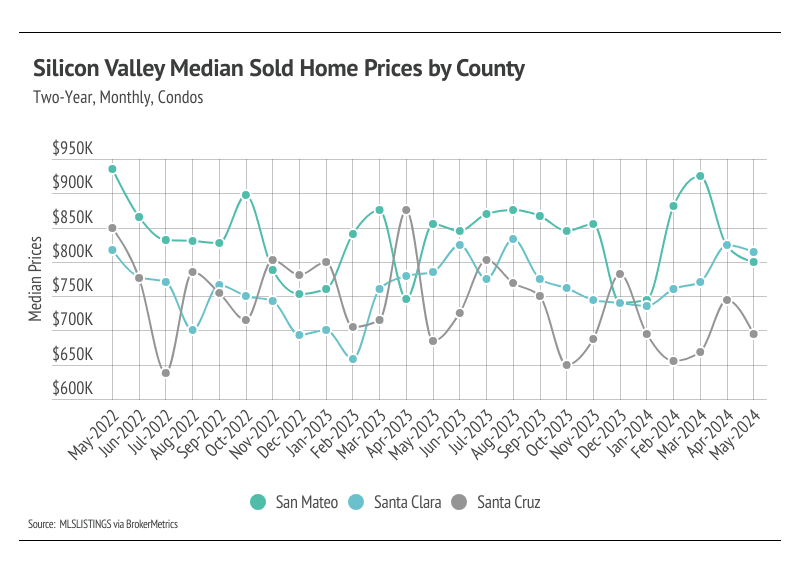

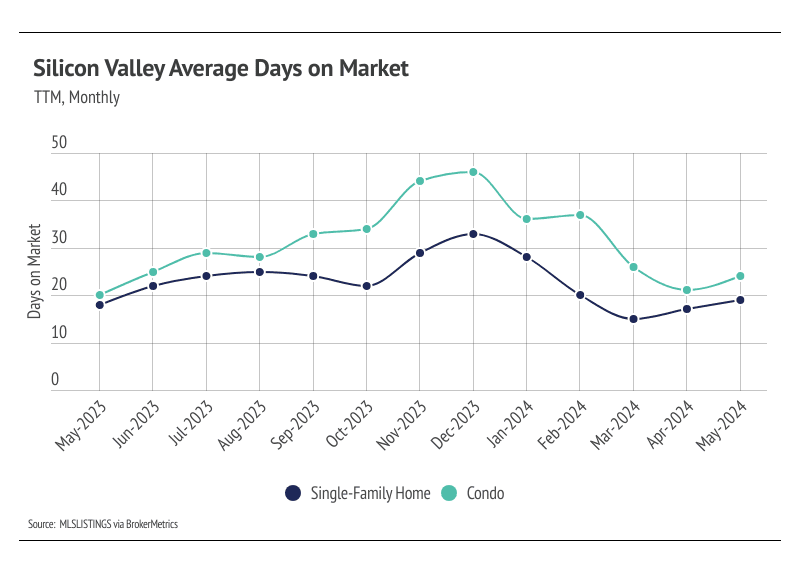

In Silicon Valley, low inventory and high demand have more than offset the downward price pressure from higher mortgage rates. Home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from May 2022 to January 2023. In 2023, prices trended horizontally, but in 2024, prices have begun to rise meaningfully. Month over month, in May, the median single-family home price rose 12% in San Mateo and 5% in Santa Clara, but fell 5% in Santa Cruz. Conversely, condo prices fell slightly month over month across Silicon Valley. We expect prices in Silicon Valley to remain at or near peak until the early summer. Low, but rising inventory is buoying prices as buyers are better able to find the best match.

High mortgage rates soften both supply and demand, but home buyers and sellers seemed to tolerate rates above 6%. Now that rates are above 7%, sales could slow once again during the time of the year when sales tend to be at their highest.

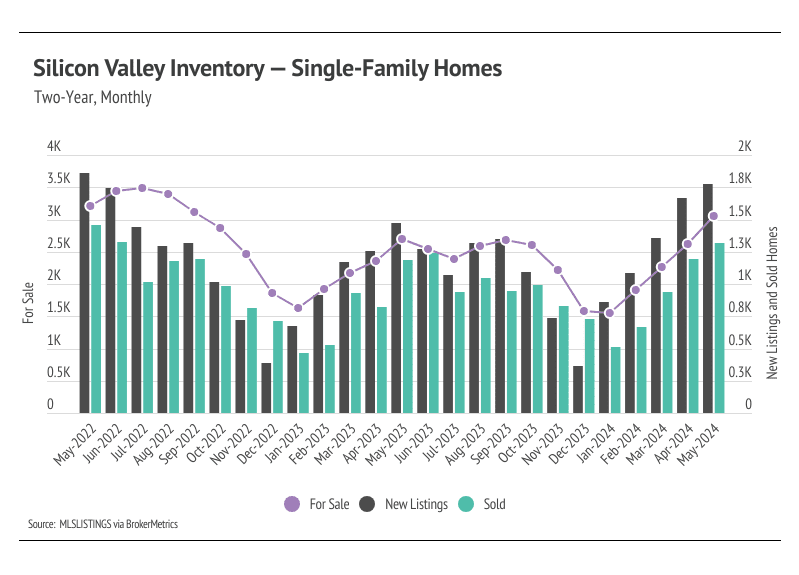

Since the start of 2023, single-family home inventory has followed fairly typical seasonal trends, but at significantly depressed levels. Low inventory and fewer new listings have slowed the market considerably. Typically, inventory peaks in July or August and declines through December or January, but the lack of new listings prevented meaningful inventory growth. Last year, new listings and sales peaked in May, while inventory peaked in September. New listings have been exceptionally low, so the little inventory growth in 2023 was driven by softening demand. In December 2023, inventory and sales dropped, but more new listings have come to the market in 2024, which has driven the significant increase in sales so far this year. The market is already looking healthier, and we expect more new listings and sales in the summer months.

With the current inventory levels, the number of new listings coming to market is a significant predictor of sales. New listings rose 5% month over month, and sales followed suit, increasing 9%. Year over year, inventory is up 19%, and sales are up 10%. Demand is clearly high in Silicon Valley, and more homes for sale have equated to more homes sold.

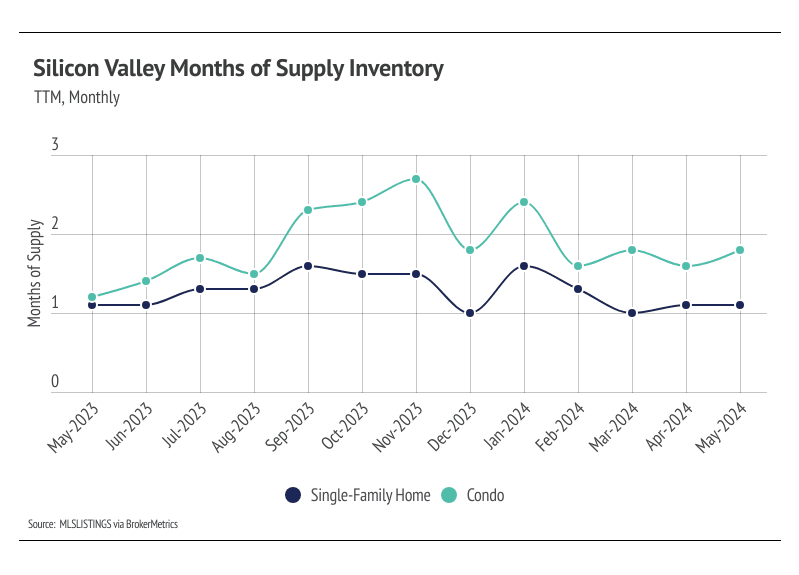

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The Silicon Valley market tends to favor sellers, which is reflected in its low MSI. MSI trended higher in the second half of 2023, but never climbed above three months of supply. From January to April 2024, single-family home and condo MSI fell significantly, indicating the housing market strongly favors sellers.

Stay up to date on the latest real estate trends.

What does Q4 hold for Silicon Valley real estate?

Median home prices are slightly below peak levels across Silicon Valley.

Prices will likely decline for the rest of the year.

Single-family home prices in Santa Cruz reached a record high in June.

Single-family home prices in San Mateo and Santa Cruz reached all-time highs in May

Whether you're looking to purchase or sell, get expert advice and personalized support every step of the way.